Annualization is just around the corner. Get ready now and beat the stress.

Preparation is key

The end of year is fast approaching which means annualization is around the corner.

We believe that starting the process in late August will significantly reduce the amount of time it takes to manage the entire process because starting early means that you can be methodical and get it done right. This avoids errors being found at the last minute and needing lots of rework.

Over the next weeks, we will provide a series of templates, checklists and a step-by-step guide to how to make annualization easier.

It doesn’t matter if you use manual excel files, a basic payroll system or an advanced system like Finn because starting early is going to make your life so much easier.

If you are using a payroll system and you’ve been told that running annualization is as simple as one click, while technically correct, we believe it is misleading. A payroll system is just a giant calculator and just like a handheld calculator, if you enter the wrong input, the answer will be mathematically correct but the answer is actually wrong.

When running annualization, we must first assume that:

- Humans make mistakes when entering data.

- Data may not have been loaded to the system.

- Data may have been deleted.

So, whether you are doing it manually in Excel or using a system, step one is to assume the source data is wrong and validate it is correct before you even start to run the annualization.

The following tasks are a good starting point for

- Gather a list of all new hires in 2021 and identify everyone in this list who has not submitted a 2316 form their former employer.

- Send them a reminder that they must provide the form as soon as possible to ensure they do not end up with additional tax due.

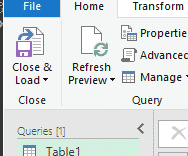

- Gather a list of all bank deposits made for 2021 (you can use this template) and ask finance to confirm that the amounts in your file match what has been posted to the accounting system. We are looking to confirm that there were no special payments made to employees that were not loaded to the system.

Want to be kept up to date?

Sign for our newsletter below.

Check out one of our other articles about using the un-pivot table function.

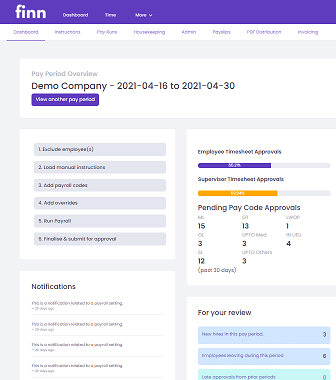

FInn helps you achieve zero payroll disputes

Learn more about how Finn can help you run fast and error-free payroll.